- Explore what you want to buy in stores and then buy it on the Internet at home. Use your search engines.

- Always negotiate in small business owned stores. You can try in the larger stores but the sales people often have no delegated power to negotiate with you.

- Ask for discounts for cash.

- Try home exchange schemes instead of renting villas and apartments.

- Forget designer labels and go to TK Max, Primark, George at Asda, etc.

- Don’t buy new. You can buy second hand copies of books from Amazon online that are hugely discounted from the price of new ones.

Tuesday, 23 December 2008

Recession Tips 3 - 8

Monday, 22 December 2008

Sandwich Generation feels the pinch

There is much discussion as to the impact of the recession on the over 50's but one of the reasons why this age group may find things more difficult is because of the financial support they are consistently giving to their grown up children and to their ageing parents. This is to the tune of more than £1.5billion a year.

More than 250,000 Britons are currently paying for their grown-up children and at least one ageing parent, according to research by Unbiased.co.uk website, which searches for financial advisors.

Many will spend so much money looking after the young and the old that they are left with very little left for themselves.Overall people who make up the sandwich generation are spending more than £124million every year supporting their children and parents, more than £1.5billion a year.

The research found that 3.3million parents are currently supporting children aged 21 or over at an average cost of £254 a month.

This works out as a total cost of more than £10.2billion a year.

Meanwhile more than one million people are supporting their aging mothers and fathers at an average cost of £244 a month, or £2.8billion a year.

Over 55's are savvier online shoppers

Online shoppers in the 55+ age bracket are apparently far more likely than 16-24 year-olds to use Web 2.0 resources like blogs and forums in advance of any purchases, according to web hosting firm 1&1 Internet. Its survey found that 70% of older respondents do their research online before committing to purchases, compared to just 53% of the youngsters. So either these ‘silver surfers’ are just more in tune with the Web 2.0 blogosphere – or they’re a lot more careful

Checking for online feedback is now becoming an increasingly common part of online buying decisions. Overall, about two-thirds of those questioned said they regularly check the internet for material about the specific retailer before they make a purchase, while 46% said they tried to read some kind of online review about the particular product. Indeed, we’re increasingly reliant on the feedback that other users leave about previous purchases – around 40% said they routinely rely on websites’ star ratings and rankings. An assiduous 24% even go to the lengths of looking for customer service commitments on the website.

One in three of us is now perfectly happy to leave a review of a site or product after we make a purchase, whereas only one in five can be bothered writing a letter (although statistically, people still prefer the more old-fashioned approach of actually speaking to people about their experiences). And interestingly, this is probably good news for smaller retailers, at a time when they’ve never needed it more: now that it’s so easy for people to get feedback on the most unfamiliar of sellers, they’re more likely to trust them with their money. Well, as long as the feedback’s good.

Saturday, 20 December 2008

50+ women are more irritable in marriage than men

A Saga survey of 800 50+ women and men shows that women are for more annoyed with their men than the other way around.

Four in five women admitted they found certain aspects of their husband's behaviour irritating.

Men are more forgiving, with four in ten (40 per cent) finding nothing irritating about their spouse.

In total, only one in five people (22 per cent) said that nothing irritates them about their spouse.

The survey comes in the run-up to Christmas – one of the few times throughout the year when many couples spend a significant amount of time at home together.

The biggest frustration for men was their wives always wanting to do things their own way (19 per cent) and their wives making arrangements without consulting them (14 per cent).

The survey looks at the common complaints in marriage for the over-50s.

The top five for women include:

*Being taken for granted (26 per cent)

*Having an untidy partner (24 per cent)

*Their husbands insisting on always doing things their own way (24 per cent)

*Their husbands leaving all the housework to them (17 per cent)

*Their husbands undermining them in front of others (13 per cent)

Helping out with the housework shows the widest difference in attitudes with just two per cent of men admitting this was a cause of friction compared to 17 per cent of women.

Despite these findings, the over 50s couples still enjoy being with each other as more than three quarters (83 per cent) believe that spending time together is the most important aspect of marriage.

Tuesday, 16 December 2008

Recession Tips 1& 2

1) Are you paying unnecessary tax on your bank or building society interest?

For the last week or so HMRC have been running a campaign to remind people who are not taxpayers - including many pensioners - that they should register with their bank/building society to get their interest paid without tax deduction. Banks & building societies take 20% tax off before paying their interest to their savers. So someone who is a non-taxpayer then has to claim it back from HMRC or they can register with the bank/building society (with a form R85) and get it paid without tax deduction. You can also get free tax advice from Tax Help for Older People if your household income is less than £15,000 per year and you are a pensioner.

2) Make sure you are not paying national insurance once you have reached state pension age. This is particularly important if you have been or are still self employed.

Thursday, 11 December 2008

Over-50s Could Spend Millions More Online

The over-50s hold the key to continued growth in online food and grocery shopping, according to new consumer research from international food and grocery expert IGD. The report, called the Golden Generation predicts that the value of online food and grocery shopping will nearly double in size by 2013 to be worth £6.2bn (up from £3.2bn in 2008). It suggests that older people today remain open to new ideas and experiences and many enjoy shopping online. However, food and grocery is lagging behind certain other categories and there are some barriers to overcome.

The key issues are delivery charges; ease and security of ordering; and product reliability.

In a survey of just over 1,200 older shoppers (50+) conducted in the autumn, 27% said that they would start shopping for food and grocery online in certain circumstances.

- Nearly half (48%) of those considering online food and grocery shopping would do so if various price issues were dealt with - eg, scale of delivery charges for small orders, guaranteed same prices as in store, and the same promotions available

- More efficient and secure ordering was mentioned by 46% - including greater security against ID fraud, better view of products on the web site and a quicker ordering process

- Two fifths (39%) were unsure about the reliability of product quality and delivery - suspecting, for example, that they would receive products with a short shelf life.

Saturday, 6 December 2008

The Rainbow Years published at last!

Mike and I are delighted to announce that our book has been published this week. In addition to bookshops it can be bought at Amazon.co uk, play.com, and also from www.fiftyforward.co.uk. We should point out that all 3 of these sources offer a guaranteed discount. You will probably also get discounts in bookshops but clearly that is unknown to us.

This feels like an important milestone - but only one. That is why we are continuing with this blog and also to contribute to the learndirect fifyforward website. So do watch this space ...

Thursday, 4 December 2008

Grandmas don't know everything...

Well - to hell with that! At our ages we should be able to enjoy some humour so from time to time will share items with you that amused us. Here is one that arrived today.....

Little Tony was 9 years old and was staying with his grandmother for a few days.

He'd been playing outside with the other kids for a while when he came into the house and asked her,

'Grandma, what's that called when two people sleep in the same room and one is on top of the other?'

She was a little taken aback, but she decided to tell him the truth. 'It's called sexual intercourse , darling.'

Little Tony said, 'Oh, OK,' and went back outside to play with the other kids.

A few minutes later he came back in and said angrily,

'Grandma, it isn't called sexual intercourse . It's called Bunk Beds.....

.....And Jimmy's mum wants to talk to you.'

Wednesday, 3 December 2008

Grandma puts pension at risk when she stays at home to care for grandkids

The Daily Mail has launched a campaign to highlight the fact that although there are fairer pensions for stay-at-home mums, grandparents who are increasingly playing a major caring role in the family are at risk of being disadvantaged with their pensions. They point out that more than half a million families rely on grandparents to help care for their young children. But in fulfilling this vital family role, which is allowing mums and dads to earn a living, the grandparents are throwing away their chances of a decent state pension.

With the average age of becoming a grandparent just 51 or 52, this means grandmothers are jeopardising their pension prospects.

Unlike registered childminders, they don't qualify under the child-care tax system. Even if the child were looked after by a neighbour, the taxpayer would foot 80 per cent of the childcare costs to a weekly maximum of £175 for one child. The 55-year-old grandmother would not get a penny.

To qualify for a full state pension of £90.70 a week, women have to build up 39 years of national insurance contributions. This is being reduced to 30 for those retiring after April 6, 2010.

Samantha Smethers from Grandparents Plus adds: 'So many grandparents give up work to care for their grandchildren, yet they are being taken for granted.

'Many mothers prefer their children to be looked after by a close family relative rather than entrusting the care of their child to a complete stranger.

'More than 90 per cent of stay-at-home grandmothers do it for nothing. The least we can do for them if they do give up work to care for their grandchildren is to ensure that they don't miss out on the chance to secure that full basic state pension in retirement.'

The Government says that grandparents will benefit from the new rules allowing them to buy back extra years of missing NI contributions.

This seems to us a campaign that needs supporting.

Blueberries 'reverse memory loss'

Eating blueberries can reverse memory loss and may have implications in the treatment of diseases like Alzheimer's, University of Reading scientists claim.

Scientists found adding foods like blueberries to a regular diet, resulted in improvements in memory.The foods, known as flavonoids, were historically believed to act as antioxidants in human bodies.But the study indicates they also activate the part of the brain which controls learning and memory.

Dr Jeremy Spencer, from the department of food biosciences at the university, said: "Scientists have known of the potential health benefits of diets rich in fresh fruits for a long time.

"Our research provides scientific evidence to show that blueberries are good for you and supports the idea that a diet-based approach could potentially be used to increase memory capacity.

"We will be taking these findings to the next level by investigating the effects of diets rich in flavonoids on individuals suffering from cognitive impairment and possibly Alzheimer's disease."

The research has been published in the Free Radical Biology and Medicine journal. And the cost of blueberries in the winter credit crunch - but maybe its worth it!Tuesday, 2 December 2008

Prime and Bank of America combine to encourage entrepreneurship

A new £2 million three-year partnership has been set up between the Prince of Wales' charity Prime (The Prince's Initiative for Mature Enterprise) and the Bank of America Charitable Foundation tolhelp the older unemployed get back into business. Start-ups will be offered encouragement, mentoring and investment under the scheme, which is supported by the Government.

Business Secretary Peter Mandelson said: "There is no age limit on entrepreneurial spirit. During the current economic climate it is even more vital that older people have the confidence to make their business ideas a reality."

Research carried out by the bank on behalf of Prime found 16% of those aged 55 to 64 have considered, but not realised, their ambition of establishing their own business. Some 53% of over 50s feel they are at a disadvantage to younger people in the job market. And 81% say it is the attitude of employers to age that puts them at this disadvantage

The survey of 1,000 adults, including 472 over 50s, also found 54% of older people looking for work think the credit crunch will dent their employment prospects.

The charity said there are 3.6 million unemployed UK people aged 50-65, with the over 50s suffering the highest long-term unemployment rate.

Businesses launched by people over 50 now account for 15% of all start-ups in England and Wales. And whereas companies started by older people have a 70% chance of surviving the first five years, companies started by younger people have just a 28% survival rate.

According to Prime, if 1% of out of work over 50s became self-employed, 25,000 jobs would be created and £175 million would be saved in benefit payments.

Monday, 1 December 2008

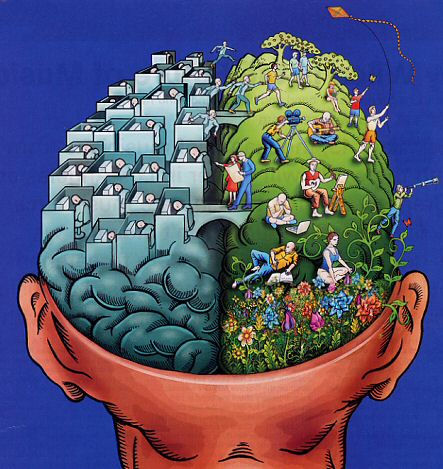

Happy retirement roadmap

So what are the components of ‘psychological wealth’ and the resulting happiness? Ed Diener’s extensive research suggests these are our positive attitudes towards life and the world around us, the quality of our relationships with family and friends, our health, our involvement in work that we find meaningful and aligned with our values, our spiritual development that commits us to causes that are greater than ourselves, our adequate material resources, a focus on the happiness of ‘now’ (‘smelling the roses’, seeing the positives now rather than aiming at some future happiness). Diener calls this happy state ‘having a balanced portfolio’ and he reminds us that ‘happiness takes work’.

The possibility of combining this awareness with the natural wisdom that comes with ageing gives the 50+'s a great platform for building happy, holistic, portfolio retirements.

Sex the number one leisure activity for credit crunch days

As the credit crunch bites, Britons may be turning to sex as a cheap way to pass the time, a charity says.

A YouGov survey of 2,000 adults found sex was the most popular free activity, ahead of window shopping and gossiping.

The Scots were most amorous with 43% choosing sex over other pastimes, compared with 35% in South England.

Aids charity the Terrence Higgins Trust, which published the survey, also welcomed recent figures showing an increase in condom sales.

Around one in 10 respondents to the survey, carried in November, said their favourite free activity was window shopping and 6% chose going to a museum as the cheapest way to pass the time.

But the sexes differed on their priorities, with women preferring to gossip with friends while men had sex firmly at the top of their list.

And of course we have already quoted previous research to the effect that the over 50's, 60's and 70's are getting more than their fair share of this!

Sunday, 30 November 2008

Boomers still saving for the future

More than eight out of ten (83%) people over 50 say they are still saving for their retirement, according to The Savings Outlook Report from Alliance & Leicester Savings*.

Financial security in later life is a real priority for this group and 42% said they are making, or have made, sacrifices to help ensure they enjoy a comfortable retirement. Almost half (48%) say they will have to save for longer because of increased life expectancy. Furthermore, just under half (48%) are concerned that the changing economic climate will have a negative impact on their enjoyment of retirement.

The Alliance & Leicester Savings report found that the majority of people (58%) over 50 do not harbour any illusions of an extravagant retirement lifestyle, but are instead seeking to balance living well now with providing for a secure future.

There is a mixed picture of how those approaching, or already in, retirement feel about the financial decisions they have made in the past. Almost half of these ‘Silver Savers’ (48%) regret not giving enough thought to their finances in years gone by. Only a quarter (26%) of those surveyed say they live for today, spending now, as and when they choose, while the majority are holding back and striving to protect their retirement savings pot.

So - maybe we boomers are a bit more responsible than some press reports suggest.

Friday, 28 November 2008

Grandparent of the year - but be quick

This is the time to drop some hints in the right direction! Age Concern has been running the Grandparent of the Year competition for 18 years. The award is run in association with Specsavers and recognises the valuable contribution grandparents make to society and to the economy. One in four families rely on grandparents to look after children each week and this childcare, provided for free, is worth £3.8million to the UK economy. Grandparents are often mentors in family life, helping to build understanding between generations.

Anyone over the age of 6 can nominate on-line at www.ageconcern.org.uk/grandparents or by sending a written nomination to Age Concern England. Nomination forms are also available in local Specsavers Stores, the location of the nearest Specsavers store can be found at www.specsavers.co.uk .

Age Concern & Specsavers will select thirteen regional winners from around the UK. From these five will be chosen to progress to the next stage as National Finalists. The finalists will be invited to London, along with their nominating grandchild, on an all expenses paid trip to take part in the awards ceremony and visit some of the capital’s top attractions. The announcement of the winner of the Grandparent of the Year 2009 will be at a reception at the House of Commons hosted by GMTV presenter, Fiona Phillips.

The Prize

The Grandparent of the Year 2009 will receive £3,000 cash to spend as they wish plus £2,000 in hearing vouchers and £750 in eyecare vouchers, courtesy of Specsavers.

Timing

Sunday 5th October – launch date

Sunday 30th November – competition close

January 2009 – Regional Winners announced

February 2009 – National Finalists announced

Wednesday 25th March 2009 – Winner announced

Friday, 21 November 2008

We've had enough and we're off...

The prospect of living through a recession is driving more than 400,000 over 50s Brits to consider packing their bags and leaving the UK for good to improve their financial position, according to new research from RIAS, specialist insurer for the over 50s.

Sounds dramatic doesn't it! There may be some truth in this but as a psychometrician - my first job - I would want to know much more about the survey questions. Asking people if they like the idea of moving abroad is one thing. Asking them if they intend to do so is something else. It is always sensible to be sceptical about surveys - especially those carried out by commercial organisations with something to sell. Having said that this still tells us something about levels of comfort and satisfaction being experienced by the over 50's.

Tuesday, 18 November 2008

'Harvest Time .....?'

- one prepares ahead and doesn't come to a 'full stop' but rather a 'tailing-off' of full-time work and a 'moving-on' to a new, thought-out pattern of life;

- it is a mistake to think of retirement as 'doing nothing', as simply a chance to 'do all that list of jobs one never got round to', a chance to be on 'permanent holiday', a chance to be with one's partner 'all of the time' (not many relationships can survive that!) unless of course any of those 'works for you'!;

- one needs to be clear about one's 'needs' that were met in full-time work. Working with people who had lost their jobs made it clear to me and them that they were losing more than income. They were losing they said, 'a purpose', a 'place to go every day', a reason to get out of bed', 'status and respect in the eyes of the family and the community'', 'identity', a 'chance to use their skills', a 'chance to go on learning', 'contact with colleagues and customers', 'challenge and support', a chance to 'make a contribution' and 'experience fulfillment', 'motivation';

- our full-time working life has been a major way of us having a whole range of important 'needs' met. Typically, we will have put the requirement to meet all those needs into the 'one basket' of our job;

- our full-time work may disappear but 'our needs' do not disappear with it. The challenge is to find new ways to have our important needs met;

- the challenge in retirement is to design a 'portfolio life' that combines a range of activities, involvements and options that do meet our own unique pattern of needs.

I am fortunate enough to know an appreciable number of people who have done just that, who love retirement, who 'wonder how they ever found time to work' (cliched but true for many) and who are vastly enjoying their 'harvest time'. In future postings on this blog I would like to share some of my observations on what they do that makes it work for them. I would also greatly welcome any contributions from any source on 'making retirement work' that we might pool and share for the benefit of each other!

Monday, 17 November 2008

And in the USA......

The mature market entrepreneurs are a driving force behind the American economy. Mature Americans, aged 55 to 64, create businesses at the highest rate of any age group — 28% higher than the average (source: Kauffman Foundation).

In response to this mature market wave of entrepreneurs, The U.S. Small Business Administration has unveiled a new website, www.sba.gov/50plusentrepreneur. The new site features interactive information and links to help 50-plus entrepreneurs consider the benefits and rewards of business ownership, and to help them make informed choices about business ownership.

And in Australia

Australians have radically changed their attitude to retirement, abandoning the hope of leaving the workforce at age 55 and opting now for an average of 65.1 years.

That was one of the key findings of research presented today at the Association of Superannuation Funds of Australia national conference being held in Auckland, New Zealand.

The research, conducted by McNair Ingenuity, also confirmed that people aged between 50 and 65 were more likely to be using a financial planner.

Consistent with other previous research, the McNair data also revealed that people aged over 50 were far more realistic about their likely retirement incomes.

Wednesday, 12 November 2008

Oldies are more realistic

By contrast, older people (aged over 65) were more accurate in recalling their prior and future life satisfaction - in this case, to do so probably reflected their need to accept their life as it had been lived, combined with their greater understanding of our capacity to adjust emotionally to

whatever life throws our way. Indeed, in line with the predictions of the older participants, most people's life satisfaction, in this study and others, actually changes very little through the years (in Western democracies, at least).

Lachman's team also looked out how adaptive it was for people to have either rose-tinted or darkly clouded views of their past and future. The results showed that at whatever age, it is beneficial to have a more realistic view of the past and future. Those participants who more accurately perceived their past and future happiness tended to suffer less depression and enjoy

better health.

The Mature Market Segmentation Model

Well this mouthful is from a site called Millennium a company that specialises in marketing to the over 50's. I was especially interested as they get into the problematic area of what to call us as they segment us for marketing purposes. They call their model the New Majority which they claim incorporates what they have learned about this market in over 12 years of research, analysis and communications.

They define us as – Thrivers (50-59), Seniors (60-69), Elders (70-79) and Survivors (80+). Well I definitely do not like to be called a senior, Mike is not exactly enthusiastic about being titled an elder and we have friends in their 80's who strongly object to being called survivors. "Makes us sound as if we are sitting in death's waiting room".

This nomenclature problem is very difficult indeed. It would be interesting to get some opinions on this.

Saturday, 8 November 2008

Flirty fifties again

A new survey of over 2000 people from the Sagazone was reported in an article in the Daily Express.

Apparantly 50+'s are just as likely to be unfaithful as younger people.

So now you know!

Nobody likes to be forcibly retired

The Irish Times has just reported a story about a fireman with an “impeccable record” who has brought a High Court action aimed at preventing Drogheda Borough Council retiring him.

Patrick Reilly (58) has been employed as a retained firefighter with the council since 1980 and wants a declaration from the court that an agreement between him and the council means his retirement age is 65. He is also seeking an injunction preventing the council from retiring him until he reaches 65, plus damages.

The council is opposing the action and denies Mr Reilly’s retirement age is 65.

Over in the Uk we are still awaiting the full outcome of the Heyday case in the Hague on this issue and the current goverment are prevaricating until 2010 when presumably they hope that the decision will have been made for them. Watch for many more of these stories.

Monday, 27 October 2008

The Empty Nest - we wish!

In some households up to 4 generations are sharing the same property! One reason is the ever increasing amount of student debt, then the problem of getting on the property ladder, sometimes unemployment and sometimes it is just more comfortable emotionally as well as financially to be just looked after!

Kids - don't you just love 'em! What do you think?

Friday, 24 October 2008

George Carlin's Views on Ageing

My daughter just send me George Carlin's Views on Ageing. Its friday night so enjoy! Do you realize that the only time in our lives when we like to get old is when we're kids? If you're less than 10 years old, you're so excited about aging that you think in fractions. 'How old are you?' 'I'm four and a half!' You're never thirty-six and a half. You're four and a half, going on five! That's the key You get into your teens, now they can't hold you back. You jump to the next number, or even a few ahead. 'How old are you?' 'I'm gonna be 16!' You could be 13, but hey, you're gonna be 16! And then the greatest day of your life ! You become 21. Even the words sound like a ceremony. YOU BECOME 21. YESSSS!!! But then you turn 30. Oooohh, what happened there? Makes you sound like bad milk! He TURNED; we had to throw him out. There's no fun now, you're Just a sour-dumpling. What's wrong? What's changed? You BECOME 21, you TURN 30, then you're PUSHING 40. Whoa! Put on the brakes, it's all slipping away. Before you know it, you REACH 50 and your dreams are gone. But wait!!! You MAKE it to 60. You didn't think you would! So you BECOME 21, TURN 30, PUSH 40, REACH 50 and MAKE it to 60. You've built up so much speed that you HIT 70! After that it's a day-by-day thing; you HIT Wednesday! You get into your 80's and every day is a complete cycle; you HIT lunch; you TURN 4:30; you REACH bedtime. And it doesn't end there. Into the 90s, you start going backwards; 'I Was JUST 92.' Then a strange thing happens. If you make it over 100, you become a little kid again. 'I'm 100 and a half!'

First-time blog - Mike Scally

Thursday, 23 October 2008

How the 50+'s rely on the Internet

New research from Alliance & Leicester Current Accounts has revealed the extent to which the over 50s rely on the internet to help organise different areas of their lives, from their finances through to their love life.

These days, nearly three fifths (58%) of over 50s use the ‘net' to manage their finances, a further two in five (41%) book their holidays online, and almost one in five (18%) regularly log on to social networking websites such as Facebook and Friends Reunited.

With so much use of the internet, it is not surprising that online security is important to the over 50s. While six in ten (59%) of the over 50s say they are happy to buy products online, more than a half (51%) say they need to be sure a site is safe and secure before buying anything, and more than a quarter (27%) will only shop online at UK websites.

It seems that location matters too when it comes to using the internet. While two thirds (64%) feel confident using online banking in the safety of their own home, only 5% feel safe checking their bank balance at work, and only 2% would risk logging-on to their online banking at a shared or public computer, such as a library or internet cafe.

The over 70s have the least confidence to carry out their banking online, with almost one in three (31%) saying they have ‘no confidence at all' banking online, compared with only one fifth (21%) of those aged 50-59. Those over 70 are also more wary of giving their bank details online and more than a third (35%) will only pay for items online with a credit card, compared with just (27%) of those aged 50-59.

Over 50s use of the internet: men v women

There seems to be a divide between the sexes when it comes to having confidence in online banking. Seven out of ten (70%) of men over 50 feel confident banking online at home, compared to only 59% women. Almost one third (30%) of women believe online banking is unsafe and only 29% of women over 50 are happy to input their debit card details when buying online.

However, men over 50 are more conscientious about internet security than women, with almost two thirds (63%) of men claiming to always ensure their security software is up-to-date, with just 56% of women doing the same.

The Joys of Being a Grandparent - I think?

In our book we talk a lot about the grandparent role and the statistics are quite enlightening:

- in the UK 90% of people over 65 are grandparents

- 25% of children are regularly looked after by grandparents

- 60% of childcare other than by parents is done by grandparents saving £4 billion a year assuming minimum wage payments

- 44% spend 16 hours a month providing childcare

- 92% of them get no payment

Tuesday, 21 October 2008

Rolls Royce loses landmark age discrimination case

The Times reports today that Unite, Britain’s biggest union, today won what it hailed as a landmark ruling in one of the first cases on age discrimination to be considered by the courts.

A judge in the High Court in London ruled in favour of Unite in a legal dispute with Rolls-Royce over whether long service should be taken into account when selecting workers for redundancy.

The union hailed the ruling as setting a precedent for protecting older workers from redundancy.

What I found particularly sad about this were some of the comments that appeared online following publication. I reproduce 2 to illustrate what we are up against:

'Last in, first out' policies are fairer than discriminating against older workers in my opinion. I am 18, you can't call me biased! It's just they are somewhat less attractive to new employers as the older you get, the harder it is to learn new information, so they viewed as harder to train!"

'So the old timers have the best pensions and the most employment protection. The young, well they just have to pay the taxes to support the old people whilst not being able to afford to buy a house or save for a pension and now fired before the old! Not a long run solution is it?'

These illustrate what could be growing resentment from younger generations to what they see as onerous commitments and also the stereotyping that still exists, viz we are harder to train as we don't learn so easily. When our book is published next month look at the studies that we quote that categorically refute this.

Sunday, 19 October 2008

Boommers Still Partying

The UK has no intention of giving up its partying habits, with 80 per cent of party-goers agreeing that you don't need a champagne budget to throw a good party, according to a new report from Yell.com - the online service from Yellow Pages.In fact the biggest spending party guests are the 55-60 year old age group, spending on average GBP20 more.

Delightfully the report calls us the Older Age Party-goers (OAPs).

Friday, 17 October 2008

Surfing the Internet Boosts Aging Brains

New research suggests that the simple act of Googling may be good for your brain health.

Scientists at the University of California, Los Angeles, have shown that searching the Internet triggers key centers in the brain that control decision-making and complex reasoning. The findings suggest that searching the Web helps to stimulate and may even improve brain function.

The U.C.L.A. researchers studied 24 healthy people between the ages of 55 and 76. Half of the study participants had experience searching the Internet, whereas the other half had no experience. Participants performed Web searches and book-reading tasks while undergoing functional magnetic resonance imaging scans, which measure the level of cerebral blood flow.

While all participants demonstrated the same brain activity during the book-reading task, the Web-savvy group also registered activity in areas of the brain that control decision-making and complex reasoning, the researchers said.

“Our most striking finding was that Internet searching appears to engage a greater extent of neural circuitry that is not activated during reading — but only in those with prior Internet experience,” said principal investigator Dr. Gary Small, director of U.C.L.A.’s Memory and Aging Research Center, in a press release.

“The study results are encouraging that emerging computerized technologies may have physiological effects and potential benefits for middle-aged and older adults,” Dr. Small said. “Internet searching engages complicated brain activity, which may help exercise and improve brain function.”

During Web searching, the Web-savvy volunteers showed a twofold increase in brain activation when compared with those who had little Internet experience. The tiniest measurable unit of brain activity registered by the functional M.R.I. is called a voxel. During Internet searching, those with prior Web experience sparked 21,782 voxels, compared with only 8,646 voxels for those with less experience.

The researchers noted that compared with reading, the Internet’s wealth of choices requires that people make decisions about what to click on, an activity that engages important cognitive circuits in the brain. Dr. Small said the minimal brain activation shown by the less experienced Internet users may be due to the fact that it was a new experience, and the Web users weren’t yet adept at clicking around and making choices. He said that with more experience, the novice Web users may eventually demonstrate the same level of brain activity as the more computer-savvy participants.

“A simple, everyday task like searching the Web appears to enhance brain circuitry in older adults, demonstrating that our brains are sensitive and can continue to learn as we grow older,” Dr. Small said.

Dr. Small is the author of a new book, “iBrain: Surviving the Technological Alteration of the Modern Mind.”

Wednesday, 15 October 2008

UK employers win international award for best practice around workers over 50

Four UK employers are among ten international companies to win an award for best practice in recruiting, developing and retaining workers over 50.

The AARP International Innovative Employer Awards are designed by AARP, a US-based non-profit organisation representing 40 million members aged 50 and over, and supported by TAEN, The Age and Employment Network. The awards promote best practice from employers around the world, focusing global attention on how the skills and talents of older workers are being utilised.

A number of factors were considered when selecting this year's winners from the pool of international companies that applied, including recruiting practices; workplace culture; lifelong learning and education; job training opportunities; alternative work options such as flexible scheduling, job sharing and flexible retirement.

Of the ten winners, the four UK organisations to receive the award were:

- Agewell - Sandwell Primary Care Trust

- BT Group plc

- Centrica plc

- Domestic & General Group Limited

Sally Ward, People and Policy Manager, BT Group, said:

"Creating a workplace where people of all ages are encouraged to remain actively employed is vital to attracting and retaining the most talented people, and therefore providing the best possible service to our customers."

Mike O'Brien, Minister of State, Department for Work and Pensions, commented:

"I am delighted to see four UK businesses receiving this award. Good employers are alive to the value of older workers, spotting a growing pool of talent that many other businesses still miss out on. For the employee the benefits are obvious. The traditional 'one size fits all' approach to retirement does not suit everyone so rather than a sudden stop, they can choose to step down gradually from work. More employers need to respond to this trend and in turn, their businesses will benefit from the experience, loyalty and skills older workers can bring."

AARP Innovative Employer Award summaries

Agewell - Sandwell Primary Care Trust

- Midlife Future Planning programme helps employees consider changes faced in later life

- Flexible work arrangements giving employees a work/life balance

- No mandatory retirement age

BT Group

- Achieving Balance portfolio of flexible working arrangements help employees make transition from full-time employment to retirement

- Career Life planning Tool assists employees in developing careers at every stage

Centrica

- Age action group delivering an ageing workforce action plan

- Age awareness e-learning package for managers and employees

- Flexible work policies and carers network

Domestic & General Group

- Recruitment strategies to attract and retain older workers

- Recruitment and assessment materials tailored to resonate with various generations

- Telephone interviewing used in first stage of hiring process to avoid age-bias

- Employees as Age Ambassadors representing the company at recruitment fairs

From the Age Positive website

Work is Good For Your Health

Mike and I write about this topic in The Rainbow Years but we now have even more evidence to make the point that staying in paid work of some kind keeps you healthier. An Australian Bureau of Statistics report published in August 2008 found that workers aged between 45 and 74 were less likely to have a chronic health condition, including obesity, than people who had retired. They have lower rates of heart disease, diabetes and arthritis. Cardiovascular disease and arthritis each affect about 25% of older workers whereas 50% of those who do not have paid work are affected. So now you know!

Tuesday, 14 October 2008

Boomers learn from Generation Y

Senior execs are starting to employ GenY media like online video, social networking sites and even eBooks, according to a new report on leadership training from the Chartered Management Institute.

In the past, baby boomers have been considered a lot more technophobic than Generation Y's. We were supposed to be reluctant to embrace new technologies, and slow to use them effectively. But it seems that times are changing: 51% said they’d used online video (up from 21% a year ago), 34% have got involved with social networking sites (up from 12% last year), and about a quarter had made use of eBooks or discussion forums. This is a big leap over the course of a year – it could just be the inevitable march of progress, but it might also mean that they’re looking for efficiencies at a time when cash is tight.

50 and Romantic

Older couples are proving more romantic than those in their 20s with new figures showing that three out of four are planning four or more city breaks together this year.

A study by hotel chain Holiday Inn found that the over 50s are increasingly spending time away from home with their partners.

Spokesperson for the firm Chris Hale said: "By 50, most people have paid off their mortgage, their kids have left home and all of a sudden they have enormous freedoms they haven't enjoyed for years.

''While people in their 30s and 40s are tied down with debts and family life, the over-50s are packing their bags and heading off for romantic weekends, with great big grins on their faces."

Tuesday, 7 October 2008

Civil Service Abandons Mandatory Retirement

A number of Government departments have already introduced a no mandatory retirement age policy. In July of this year, Permanent Secretaries agreed to work together to introduce across the remaining Civil Service a no mandatory retirement age policy for staff below the Senior Civil Service by March 2010. Separate work is being undertaken by the Cabinet Office to review the potential for extending this change to the Senior Civil Service (SCS).

Since 2006 a number of departments, employing approximately 50 per cent of Civil Servants, have already introduced a no mandatory retirement age policy – these include Department for Work and Pensions, Her Majesty's Revenue and Customs, Department for Environment, Food and Rural Affairs and the Foreign and Commonwealth Office. In July, Permanent Secretaries agreed to work together to introduce a no mandatory retirement age policy for staff below the SCS in the remaining departments.

A spokesperson from the MOD's Director General Civilian Personnel Pensions team explained what today's announcement means to staff who may be planning to retire:

They make it very clear that introducing this will not affect the age at which people can take their full pension benefits but it will give them greater choice as to when they choose to retire.

The news was deliberately announced to coincide with Older Peoples Day on October 1.

Cabinet Secretary Sir Gus O'Donnell added:

"Older People's Day recognises the important contribution that older workers make in the work place. Like any successful organisation, we need people who have knowledge and experience in key areas, as well as those with fresh ideas to challenge traditional methods. I am proud that the Civil Service values all colleagues, regardless of age, and recognises that we must build on the skills and experience of an increasingly diverse workforce so that we can continue to improve the delivery of public services for everyone in society.

"The new commitment by all departments to a no mandatory retirement age policy across the Civil Service by 2010, for those below the Senior Civil Service, is an important change to our workforce policy. It is a practical demonstration of our commitment to providing greater flexibility for our people."

Catharine Pusey, Director of The Employers Forum on Age comments, “We welcome the civil service’s decision to remove the unfair and discriminatory practice of being able to insist their employees retire at 65 and hope that it helps focus the Government’s mind ahead of the result of the Heyday challenge". This refers to the case brought by Age Concern to the Hague to abandon mandatory retirement totally in the UK.

Friday, 3 October 2008

Tesco Leads the Way

reports that the number of over-50s staff has reached a record level. One in five Tesco employees are now aged over 50. There has been a 154% rise in the number of over-50s employed in its UK stores compared with 10 years ago, bringing the current total to 54,545. Some of this growth in the older workforce has been down to an increase in the retailer's overall staff numbers, but personnel manager Linda Avis also credits Tesco's pro-older people policies.

These include Tesco enabling employees to work and be developed no matter how old they are - the oldest employee currently working within a store is 80-years-old. The company also scrapped the fixed retirement age (currently the default retirement age is 65).

Working within the UK resourcing team, Avis said: "We are now seeing that our over-50 workforce is not only formed of employees who have worked their way through the ranks within Tesco, but increasingly, those who have decided to join Tesco later in life. Many of these new recruits have decided they would like a new challenge and have chosen to follow a new and exciting career path at the age of 50 or over."

Of the 1,843 people currently on Tesco's internal development programme, 366 (20%) are over 50. And more than 10% of Tesco's store manager positions are filled by the over-50s, who also account for 14% of its senior team and 10% of its line managers.

Avis added that employing the over-50s has reaped its UK stores huge benefits.

"Staff turnover is at its lowest point within the over-50 age bracket, especially the 50- to 59-year-olds," she said. "We benefit from the loyalty and reliability that this age group provides and we, therefore, endeavour to continue to tackle the outdated stereotypes about the ageing population and hope that the government will go some way to highlight the many opportunities that inter-generational working can provide."

We are collecting data on the companies that recognise the value of retaining, recruiting and developing older employees so if you know of one please let us know.